In today's interconnected digital landscape, the acquisition and dissemination of personal data have reached unprecedented levels, posing significant risks to individuals across various sectors, including reproductive health workers. At the forefront of this modern dilemma are entities known as data brokers, whose operations remain relatively unregulated, amplifying the potential dangers of doxxing — a malicious practice where private contact information is exposed to facilitate harassment. This alarming trend underscores the urgent need for enhanced data protection measures and stricter regulations to safeguard individuals' privacy and security.

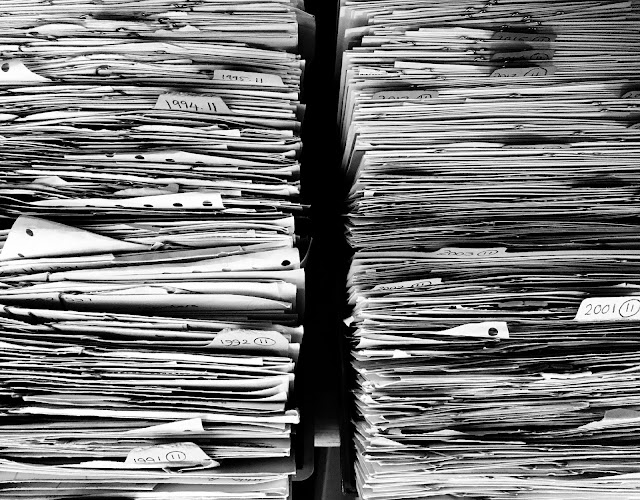

Data brokers, often operating discreetly in the background, specialize in the collection, aggregation, and sale of personal information obtained from various sources, including public records, online activities, and commercial transactions. While their activities may seem innocuous on the surface, the sheer volume and scope of data amassed by these entities raise profound concerns about privacy and security.

Reproductive health workers, in particular, face heightened risks in this digital age. As individuals dedicated to providing essential healthcare services, they often find themselves targeted by those seeking to exploit personal information for nefarious purposes. From medical professionals offering reproductive health services to counselors providing support and guidance, these professionals are entrusted with sensitive information about their clients, making them potential targets for doxxing and harassment.

The danger of doxxing lies in its ability to weaponize personal information, turning it into a tool for intimidation, harassment, and even physical harm. By exposing individuals' contact details, including home addresses, phone numbers, and email addresses, doxxers can subject their targets to a barrage of malicious activities, ranging from harassing phone calls and threatening messages to real-world stalking and violence. For reproductive health workers, whose work often intersects with contentious social and political issues, the risks associated with doxxing can be particularly acute.

Compounding the problem is the lax regulatory environment surrounding data brokers. Unlike other industries subject to stringent privacy regulations, such as healthcare and finance, data brokers operate in a largely unregulated space, with minimal oversight and accountability. This lack of regulation not only enables data brokers to continue their operations unchecked but also exacerbates the risks associated with doxxing and data breaches.

Addressing the challenges posed by data brokers and doxxing requires a multifaceted approach.

Firstly, there is a pressing need for stronger privacy regulations and oversight mechanisms to rein in the activities of data brokers and protect individuals' personal information. By imposing stricter guidelines on the collection, storage, and dissemination of personal data, regulators can help mitigate the risks of doxxing and safeguard individuals' privacy rights.

Additionally, organizations and individuals must take proactive steps to enhance their data security practices and protect against potential threats. This includes implementing robust cybersecurity measures, such as encryption, firewalls, and access controls, to safeguard sensitive information from unauthorized access and exploitation.

Moreover, fostering a culture of privacy and security awareness among employees and stakeholders can help mitigate the risk of data breaches and ensure that personal information is handled responsibly and ethically.

The rise of data brokers and the proliferation of doxxing pose significant challenges to individuals' privacy and security, particularly for reproductive health workers. To address these challenges effectively, concerted efforts are needed to strengthen privacy regulations, enhance data security practices, and promote awareness of the risks associated with doxxing. By taking proactive steps to protect personal information and hold data brokers accountable, we can create a safer and more secure digital environment for all.